south dakota sales tax exemption form

A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. Streamlined Sales and Use Tax Agreement.

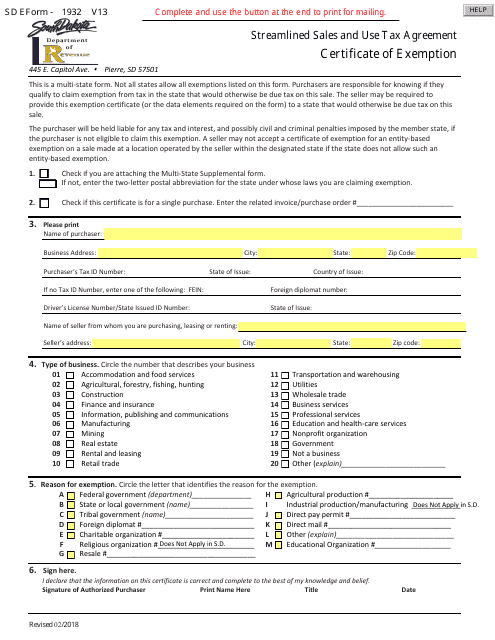

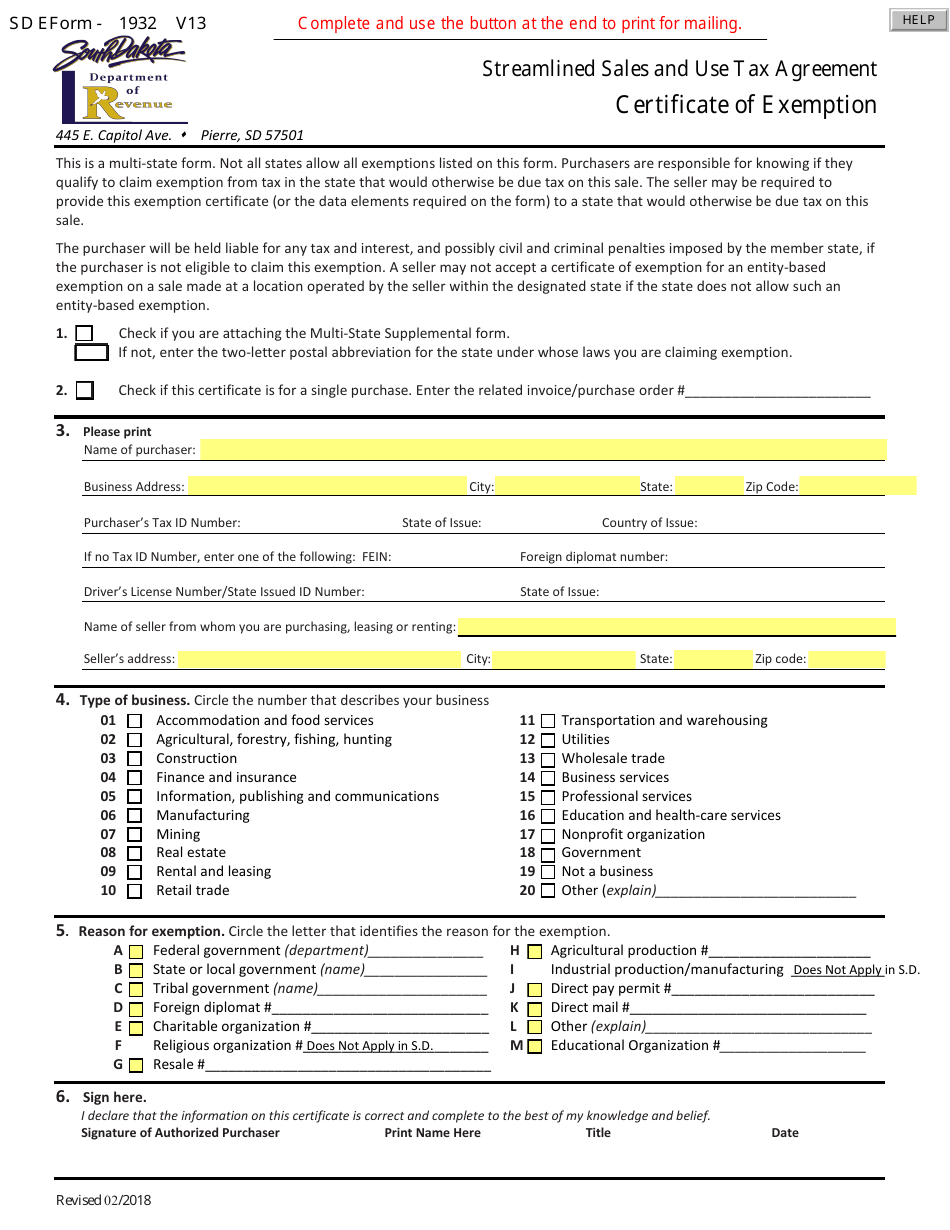

Not all states allow all exemptions listed on this form.

. This is a multi-state form. Click here for a copy of the Department of Revenue letter regarding Sales Tax Exemption. A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

Regulations and general information on South Dakota sales and use tax. States without a sales tax are exempt from South Dakota sales tax. 445 E Capitol Ave.

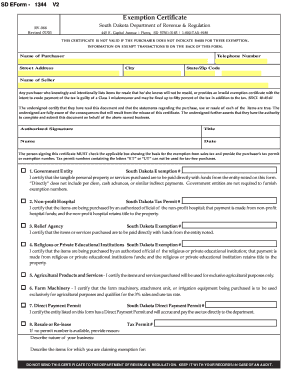

INFORMATION ON EXEMPT TRANSACTIONS IS ON THE BACK OF THIS FORM. Prime Contractors Exemption Certificate. Exemption are listed on the form.

Click on Done following double-checking everything. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax.

Exam ples of sales taxable services are. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. Please submit your request to the Department of Revenue Special Tax Division 445 East Capitol Avenue Pierre SD 57501-3185.

Not all states allow all exemptions listed on this form. Municipalities may impose a general municipal sales tax rate of up to 2. Ad The Leading Online Publisher of South dakota-specific Legal Documents.

Open it using the cloud-based editor and begin altering. South Dakota Department of Revenue. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Business Tax Filing Dates. For other South Dakota sales tax exemption certificates go here. Many states have special lowered sales tax rates for certain types of staple goods - such as.

The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B. You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page. Sales Tax Exemption Simple Online Application.

Get Access to the Largest Online Library of Legal Forms for Any State. Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that is due tax on this sale. Capitol Avenue Pierre SD 57501-3185 605-773-3541 Fax 605-773-2550 Revised 0616.

South Dakota Department of Revenue Form. Enter the permit number in Section 3. Exemption business tax tax south dakota certificate.

RV066 Revised 0703 Exemption Certificate South Dakota Department of Revenue Regulation 1-800-TAX-9188 445 E. The state that is due tax on this sale may be notified that you claimed exemption. Efficient filing of DOR tax forms.

Put the date and place your e-signature. For other South Dakota sales tax exemption certificates go here. Ad Fill Sign Email EForm-1932 More Fillable Forms Register and Subscribe Now.

Includes the letters RS or RE. The South Dakota Department of Revenue administers these taxes. Ad Sales Tax Exemption Wholesale License Reseller Permit Businesses Registration.

Send the completed form to the seller and keep a copy for your records. Some states do not offer all reasons listed. Governments providing a similar exemption are Colorado Indiana Iowa motels and hotels are not exempt Minnesota lodging and meals are not exempt North Dakota Ohio and West Virginia.

Capitol Avenue SD 57501-3185 THIS CERTIFICATE IS NOT VALID IF THE PURCHASER DOES NOT INDICATE BASIS FOR THEIR EXEMPTION. Check if you are attaching the Multi-State Supplemental Form. Name of Purchaser Street Address Name of.

Relief Agencies must have a tax exempt permit from the Department of Revenue that includes the letters RA. Must pay sales tax to the service provider on sales taxable services. Sales to United States Government State of South Dakota Indian Tribes county or local.

Several examples of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock. South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. It allows suppliers to know that you are legally allowed to purchase the.

Fill out the empty fields. For more information contact the Department of Revenue at 1-800-TAX-9188 or visit their website at httpsdorsdgov. At this time applications for this program are not being accepted.

The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat.

South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax. These states are -.

Sales of products or services purchased to be resold if pur-chaser provided an Exemption Certificate. It is the purchasers responsibility to know if the reason he is. Please check back in May 2022 for updated information on the program.

Sales of tangible personal property delivered to a location outside South Dakota. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. Applications are accepted from May 1 to July 1.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. Enter the permit number in Section 3.

Documentation Required - Government entities must provide an. You must have Acrobat Reader 40 or higher to open the file. This is a multi-state form.

Exempt Entities - Higher Education Mass Transit Tribal. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Concerned parties names addresses and phone numbers etc.

How to use sales tax exemption certificates in South Dakota. Change the template with unique fillable fields. South Dakota Department of Revenue Form.

The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. Streamlined Sales Tax Agreement Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Not all states allow all exemptions listed on this form.

MV-609 South Dakota Department of Revenue Division of Motor Vehicles. Churches are NOT exempt from South Dakota sales tax. The governments from states without a sales tax are exempt from South Dakota sales tax.

Capitol Avenue Pierre SD 57501-3185 1-800-829-9188 E-mail. Get the South Dakota Tax Exempt Form you want. These states are Alaska Delaware Montana New Hampshire and Oregon.

You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page. Services are taxed where the customer receives the service. Search for a job.

Department of Revenue Exemption Application. Churches are NOT exempt from South Dakota sales tax. This is a multi-state form.

A similar exemption for South Dakota governments. The state that is due tax on this sale may be notified that you claimed exemption.

E 595e Web Fill 12 09 Fill Online Printable Fillable Blank Pdffiller

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption Streamlined Sales And Use Tax Agreement South Dakota Templateroller

Printable South Dakota Sales Tax Exemption Certificates

South Dakota Kheops International

Form 21919 Application For Sales Tax Exemption Certificate

Form E1932 V10 Fillable Exemption Certificate

Fillable Online South Dakota Exemption Certificate Form 1344 V2 Fax Email Print Pdffiller

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption Streamlined Sales And Use Tax Agreement South Dakota Templateroller

Form Rv 093 Fillable Sales Tax Exempt Status Application

Free Form Sales And Use Tax Guide Free Legal Forms Laws Com

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

State Of South Dakota Forms Fill Online Printable Fillable Blank Pdffiller